Toronto, April 17, 2025

Canada has issued relief of Surtax (USA/Canada Trade War Tariff) for goods imported from the U.S. that are used in Canadian manufacturing, processing, food and beverage packaging, and for those used to support public health, health care, public safety, and national security objectives.

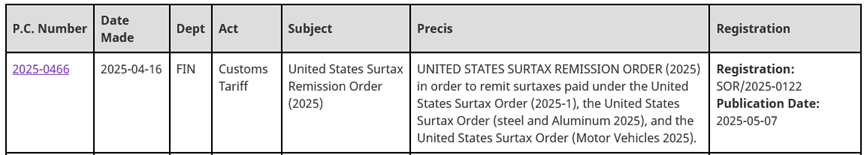

The relief, provided by Order-in-Council 2025-0466, provides immediate relief to a broad cross-section of Canadian businesses that must rely on US inputs to support their competitiveness, as well as to entities integral to Canadians’ health and safety, such as hospitals, long-term care facilities and fire departments. The remission is provided on a time-limited basis to provide businesses and entities with additional time to adjust their supply chains, and prioritize domestic sources of supply, if available.

Remission has been provided in the following instances until October 16, 2025:

Remission — public health, public safety and national security

1 Subject to section 5, remission is granted of surtaxes paid or payable under the United States Surtax Order (2025-1), the United States Surtax Order (Steel and Aluminum 2025) or the United States Surtax Order (Motor Vehicles 2025) in respect of goods imported by or on behalf of

- a government health research organization or clinical health research organization;

- an organization that produces or stores medical countermeasures, including pharmaceuticals or medical devices;

- the office of a public health official, as defined in subsection C.10.001(1) of the Food and Drug Regulations;

- an organization that provides ambulance or other emergency response services;

- a firefighting service;

- a law enforcement agency;

- a federal or provincial correctional service;

- the Department of National Defence;

- the Canadian Forces; or

- the Canadian Security Intelligence Service.

Remission — health care

2 Subject to section 5, remission is granted of surtaxes paid or payable under the United States Surtax Order (2025-1), the United States Surtax Order (Steel and Aluminum 2025) or the United States Surtax Order (Motor Vehicles 2025) in respect of goods imported

- for use in the provision of medically necessary health care services, including services provided at

- a hospital,

- a health care or dental clinic,

- a medical, dental or diagnostic laboratory, or

Remission — manufacture, processing or packaging

3 Subject to section 5, remission is granted of surtaxes paid or payable under the United States Surtax Order (2025-1) or the United States Surtax Order (Steel and Aluminum 2025) in respect of goods imported for use, in Canada, in the manufacture or processing of any good or the packaging of a food product or beverage.

Remission — goods referred to in schedule (HS tariff classifications listed below)

4 Subject to section 5, remission is granted of surtaxes paid or payable under the United States Surtax Order (2025-1) in respect of the goods referred to in column 1 of the schedule that are classified under a tariff classification number set out in column 2.

- Specialized infant formulas

– HS 2202.99.39.10 and 2202.99.39.20- Nutrition formulas, metabolic products, formulated liquid diet or human milk fortifiers

– HS 1901.90.34.90, 1902.19.11.00, 1902.19.12.30, 1902.19.12.90, 1902.19.19.00,- 30.11.00, 1902.30.19.00, 2106.90.35.00, 2106.90.39.90, 2106.90.95.90, 2202.99.39.10, and

- 99.39.20

- Medical compression garments

– HS 6115.10.10, 6115.10.91 and 6115.10.99- Sterile barrier film or pouches for use in medical manufacturing

– HS 3923.21.90.90 and 6305.39.00.00Conditions

5 Remission is granted on the following conditions:

- the good is imported into Canada before October 16, 2025;

- no other claim for relief of the surtax has been granted under the Customs Tariff in respect of the good; and

- the importer makes a claim for remission to the Minister of Public Safety and Emergency Preparedness within two years after the date of importation.

Coming into Force

4 This Order comes into force on the day on which it is registered.

Clients of Universal Logistics are requested to reach out to your Client Relations representative to advise if any of the above conditions pertain to your imports so we may take advantage of the relief once the Canada Border Services Agency (CBSA) have updated their systems and issued instructions on how to apply the relief at time of import.

For more information, please call Brian Rowe, Director – Customs Compliance & Regulatory Affairs at (905) 882-4880, ext. 1213.