CARM - Importers required to post security with CBSA on October 21, 2024

When CARM becomes the official system of record, obtaining the release of imported goods prior to accounting and payment of duties will significantly change for importers.

In October 2024, CARM will become the official system of record for the imposing or levying of duties and taxes, which will introduce:

- changes to the Release Prior to Payment (RPP) program

- electronic commercial accounting declarations that you can correct and adjust

- harmonized billing cycles

- new offsetting options

- electronic management of appeals and compliance actions

- the ability to register for a Business Number (BN9)

- enrolment in various CBSA commercial programs

Importers will no longer be able to use their customs broker’s Release Prior to Payment (RPP) security to clear shipments before paying duties and taxes. Importers who want to participate in the RPP program will be required to post their own financial security. They will have the following options:

- Option 1: a financial security instrument for 50% of their highest monthly accounts receivable (inclusive of GST), with a minimum financial security of $5,000 per import program (RM)

- Option 2: cash deposit for 100% of their highest monthly accounts receivable (inclusive of GST)

In addition to posting security, importers will be required to pay CBSA directly for all duty/GST, via online banking or with Pre-authorized debit (PAD) and credit card through the CARM Client Portal.

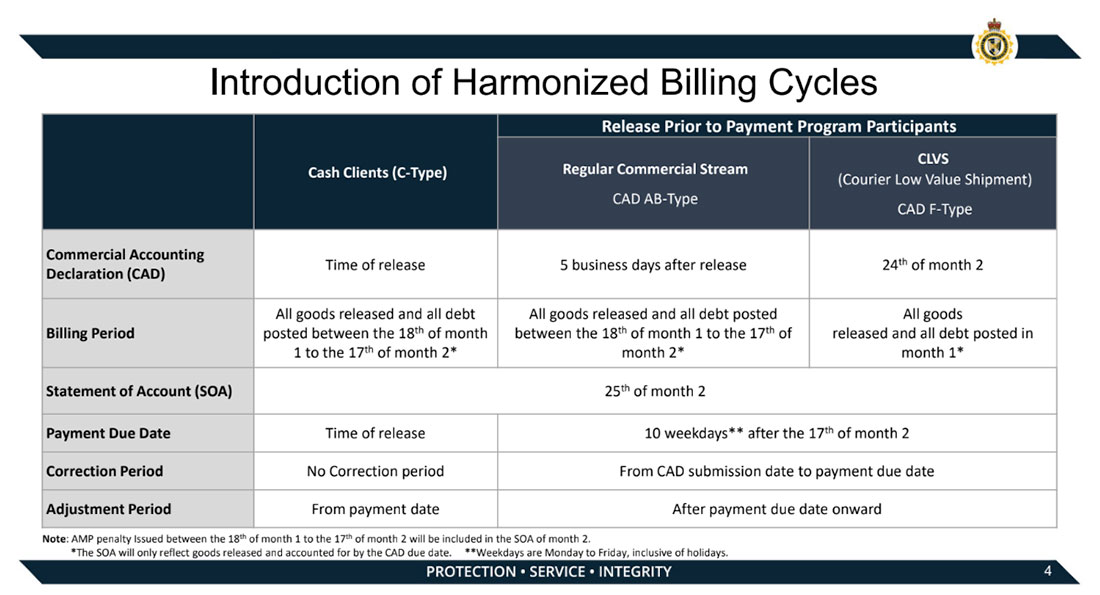

New harmonized billing cycles

In October 2024, CARM will introduce new harmonized billing cycles that align payment due dates for importers. Currently, statements are issued on the 25th of each month, with payment due by the last day of the month. The new payment due date will be 10 weekdays (defined as Monday to Friday, inclusive of holidays) after the 17th of the calendar month.

The following billing cycles will be affected by CARM:

- High-value shipments (HVS) / low-value shipments (LVS)

- Courier low-value shipments (CLVS)

- Continuous transmission commodities (CTC)

- Customs Self-assessment (CSA) program

We are ready to assist you with this registration process and happy to answer any questions you may have. Simply contact your Client Care representative or Mark Glionna, Vice President—Client Relations & Business Development.

Streamline Your Cross-Border Deliveries with Reliable Truck Freight Solutions

Universal Logistics offers comprehensive Truck Freight Services that are tailored to meet your business’s unique needs. With seamless cross-border solutions, we manage everything from trucking to Canadian and US customs clearance, ensuring efficient and reliable delivery between Canada and the U.S.. Our team is dedicated to providing you with flexible, cost-effective options that optimize your supply chain and keep your goods moving smoothly. Trust Universal Logistics to handle your truck freight with the precision and care that comes from over 75 years of logistics excellence.

For your next truck freight quote, please contact William Sanchez, Manager – Truck Services.

Air & Ocean Freight Market Update

Ocean Freight:

Asia – North America

Ocean shipping in 2024 has been fraught with unpredictability as geopolitical tensions, labour negotiations, and climate change continue to put pressure on global supply chains. Port congestion continues to be a concern at many ports worldwide, such as Ningbo, China, where a massive container explosion on August 9th shut down the port’s Phase III terminal for over 60 hours. The port of Chittagong in Bangladesh has resumed operations after political unrest led to transportation and manufacturing closures. Canada’s rail providers, CN and CPKC, are set to strike on August 22nd, unless an agreement is reached, and on October 1st, there is potential for a US East and Gulf Coast port strike. The combination of these factors makes it difficult to predict where the market is heading.

Opinions are divided on the duration of these issues. In September, rates from Asia normally increase with the traditional peak before China’s Golden Week (October 1-7). Some analysts predict rates will slowly decrease at the end of peak season (November/December), and some advise that we will not see any major rate reductions until after the Lunar New Year (end of January 2025). One global analyst warned that volatility would be a mainstay extending beyond the Lunar New Year period and that a reshuffling in the carrier alliances would continue to result in capacity limitations.

Europe – North America

Congestion at some of Northern Europe’s major container ports has worsened in the last few weeks, with carriers omitting port calls to retain schedule integrity. Since Q2 of 2024, we have been seeing a change in contract management with the steamship lines for the European to North America and Canada lanes. Steamship lines normally offer quarterly validity for European contracts, however, since Q2, some steamship lines have started to offer shorter validity of 2 months or less. As the market is staying strong, it seems they are gauging to find the right time to implement the Peak Season Surcharge (PSS). Carriers such as Hapag-Lloyd and MSC already announced early implementation of PSS effective September 1st – between $800.00 – $1,000 USD for dry containers and other carriers will follow suit.

Air Freight:

Some analysts are concerned that an East Coast port strike in the U.S. could lead to renewed disruptions and increased pressure on rates for ocean freight, as well as an increase in demand for air cargo out of Asia. Currently, e-commerce volumes are already keeping capacity tight and rates elevated during what is normally a slow season for air freight. In this type of market, space is the main concern, rates are secondary. Air freight from Europe has been fairly stable rate and space-wise, with Charles De Gaulle airport in Paris, France starting to recover from the backlog caused by the Olympics.

For more information, please contact Debbie McGuire, Director – Freight Solutions, or Cathy Fong, Director – Freight Pricing.

The US Election and its Impact on US Trade Policy

Depending on which candidate wins the upcoming US election, trade policy will be under much scrutiny, as any decisions made could have serious implications going forward.

A win by Kamala Harris is expected to continue with existing Joe Biden administration policies to leverage the economic linkages enshrined under the U.S.-Mexico-Canada Agreement (USMCA), particularly as part of its industrial policy and supply-chain securitization goals. One would expect the Harris administration to prioritize USMCA’s scheduled renewal in 2026, which forecasts assume will happen regardless of the Canadian elections in October 2025. By contrast, another Trump administration would reinject considerable uncertainty into North American trade relations.

The U.S.’s growing trade deficit with Canada and Mexico would likely be among his areas of focus. Although USMCA would initially shield Canada and Mexico from Trump’s flat-tariff plans, any trade dispute inherited from the Biden administration could easily ignite into a more serious diplomatic issue.

Trump’s threat to impose a 10% import tariff across all U.S.-bound imports represents the other main potential shock to global trade. More specifically, such a radically protectionist measure would encourage U.S. trade partners to adopt reciprocal duties. A “domino effect” of tit-for-tat retaliation would risk market-access shocks to U.S. exporters, particularly in politically sensitive export-oriented industries, such as agriculture and automotive. We would also expect these trade frictions to undermine the US trade and diplomatic coordination that the Biden administration has forged with its international partners since assuming office. This would include undermining US cooperation with the European Union on China, including regarding shared concerns over Chinese electric vehicle exports and other issues tied to Chinese industrial overcapacity. What is more likely, and what was observed in Trump’s first term, is that the U.S. would implement a “watered down” version of this threat, with tariff rates and exemptions ranging across the board – particularly for key US industries (such as automotive), as well as targeting US diplomatic partners from whom Trump would be seeking other economic and security concessions.

Other trade policy risks that are important to monitor include US tariff threats on steel and aluminum, given US domestic political factors that have kept these industries in the crosshairs of bipartisan focus. We would expect Kamala Harris to keep these tariffs suspended indefinitely as part of leverage in ongoing trade negotiations; by contrast, Donald Trump would likely reimpose them immediately. In addition to this, as highlighted by the differing views on the USMCA, a Trump administration would most likely result in the potential withdrawal from global multilateral institutions such as the Indo-Pacific Economic Framework for Prosperity (IPEF).

For more information, contact Brian Rowe, Director – Customs Compliance & Regulatory Affairs.

US Container Ports face record cargo surge ahead of possible port strike

Monthly inbound cargo volume at major US container ports is expected to approach record levels as retailers expedite shipments ahead of a potential strike at US East and Gulf Coast ports. Retailers are concerned about the possibility of a strike at ports on the East and Gulf coasts because contract talks have stalled, and many retailers have taken precautions, including earlier shipping and shifting cargo to West Coast ports.

The contract between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMA), covering US East Coast and Gulf Coast ports, is set to expire on September 30, 2024. With negotiations at an impasse, the ILA has threatened to strike if a new contract is not reached by the deadline.

The ILA has also sent notices to its employer groups that it will not offer an extension to its expiring labour deal, keeping September 30th as the cut-off date for an agreement. If a deal isn’t reached by then, East and Gulf Coast port workers will go on strike on October 1st. The ILA will present its final contract demands to the union’s wage scale committee delegates on September 4-5. An important point to note is that all East Coast and Gulf Coast cargo is moved by the ILA, which hasn’t gone on strike since 1977 when a work stoppage lasted 44 days.

Shippers are in “crunch time” as the September 30 negotiation deadline nears. Containers take an average of sixty days to be transported from eastern Asia to the US East Coast, which means importers currently seeking to get products out of this region already may have to consider alternative options, such as shipping cargo to the West Coast ports instead and moving it across the country via rail. This is a reversal of what occurred in 2022 and 2023, when East Coast ports made major cargo volume gains due to the massive vessel congestion and labour strife at ports up and down the US West Coast.

One of the differences between the ILA and their West Coast brethren, the International Longshore and Warehouse Union (ILWU), is the ILA longshoremen receive royalties based on how much tonnage they process in a year at their port. This compensation model makes it in the best interest of the ILA workers not to have cargo diverted, or their bonuses will decrease. On the West Coast, longshoremen accrue additional compensation based on man-hour assessments.

On a side note, cargo owners and their partners, intent on building in contingency plans, are also increasingly worried over the viability of the obvious solution, airfreight. Many industry experts feel this situation has the potential to be extremely disruptive for the US airfreight sector. History shows that port strikes will inevitably lead to a spike in airfreight activity, compounded by concerns over the upcoming holiday season. The timing could not be worse – if ocean-going cargo does start moving via air, it will expose another mounting concern in airfreight; e-commerce. Spiking e-commerce demand has been gobbling up a lot of the available air capacity into the U.S. in recent months, so all these factors coming together could leave airfreight exposed. If e-commerce demand remains high, and no indications show it will taper off in the near future, coupled with the port strikes leading to migration to airfreight, an air cargo capacity crisis is most likely inevitable.

Contact David Lychek, Director – Ocean & Air Services, for more information.

Global Spotlight Quiz

Name the city known for Story Bridge

- The birthplace of the country’s famous dessert – Lamington.

- Queen Street, now known for its great shopping, was the location of a convict barracks from 1827 to 1830.

- Has an average of 283 days of sun per year.

- The first cultivated Macadamia tree in the world, planted in 1858, still resides in the city’s Botanical Garden.

- Home to the country’s first and largest koala sanctuary.

- Will host the Olympics and Paralympics in 2032.

Answer: Brisbane, Australia

For more information about shipping freight to or from this city, contact Debbie McGuire, Director – Freight Solutions.

Quick Tip

What freight quotation is best for your product?

Don’t sign off on a shipment until you have confirmed the quotation is the right match for your product. For example, a truck shipment going from Los Angeles to Toronto could be quoted per pallet, per pound, per mile or per linear foot of space taken on the truck.

At Your Service

Bowen Zhu

Ocean Services

Bowen Zhu joined Universal’s Ocean Services team at Head Office in October 2022. Bowen’s main focus is handling LCL and FCL ocean imports from various origin points worldwide, each with unique and often complicated shipping requirements.

Bowen has excelled in this role, while continuing to develop and expand his knowledge. As a result, we have come to rely on his abilities and strengths to handle all types of ocean import cargo for our clients. In all cases Bowen takes on new challenges with ease and, as always, provides our clients, whether long standing or recently acquired, with the top level service they insist on.

Bowen can be reached by phone (905) 882-4880, ext. 1233 or by email.

Ocean Services

SMART Logistics

Controlling how freight moves through your supply chain could save you thousands – or more.

Working with us means someone always asks: how can we make this shipment better?

Single-sourced trucking, customs clearance and distribution to expedite your freight shipments between the U.S. and Canada.

Route is produced monthly for the clients of Universal Logistics. Reader comment and story ideas are welcome. Comments of general interest to all Route readers will, with the permission of the writer, be published. Copyright © 2024 Universal Logistics Inc. All rights reserved. Reproduction for any commercial use is strictly prohibited.

Route is produced by Universal Logistics. Editor: Bettina Scharnberg. Email: bscharnberg@universallogistics.ca While every effort has been made to ensure the accuracy of information contained herein, Universal Logistics accepts no responsibility or liability for errors or omissions. Written correspondence should be forwarded to: