CARM - Deadline to obtain or update financial security is May 20th, 3:00 am EDT

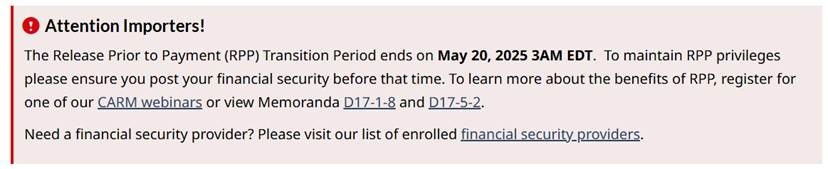

All Canadian importers logging into the CARM Portal will see the following message from the Canada Border Services Agency (CBSA):

Release Prior to Payment (RPP): Transition period

A transition period began on October 21, 2024, when CARM launched externally. The purpose of this transition period is to give importers time to adapt to using the CARM Client Portal. In order to benefit from the RPP program, beyond the transition period, importers must post their first financial security in the portal before 3 am EDT (Eastern Daylight Time) on May 20, 2025.

Please note: All importers that registered to the portal prior to October 21, 2024 or have a history of importing commercial goods into Canada within the past four years, were automatically enrolled in the RPP program and are benefiting from the transition period ending on May 20, 2025. This includes importers who use the services of a customs broker.

New importers (no history of importation) that are registering to the portal after October 21, 2024, but within the transition period, will need to enroll in RPP to benefit from RPP privileges for the remainder of the period ending on May 20, 2025.

More information:

- User guide: Enrol in a CBSA sub-program

- Customs Notice 24-27: CARM October Implementation – Transition Measures

All importers are required to post security with the Canada Border Services Agency (CBSA) by May 20, 2025, when the Release Prior to Payment (RPP) transition period ends, using one of the following two options:

- Option 1: a financial security instrument, e.g. RPP bond, for 50% of their highest monthly accounts receivable (inclusive of GST) with a minimum financial security of $5,000 per import program (RM)

- Option 2: cash security deposit for 100% of their highest monthly accounts receivable (inclusive of GST)

Recommendation – obtain a bond for a higher amount than required to avoid costly bond endorsements

(associated with fluctuations in importer security requirements)

Importers who have not yet obtained an RPP bond:

Here’s what you need to do:

To determine your Financial Security requirements, log into the CARM Portal and follow the following 3 steps:

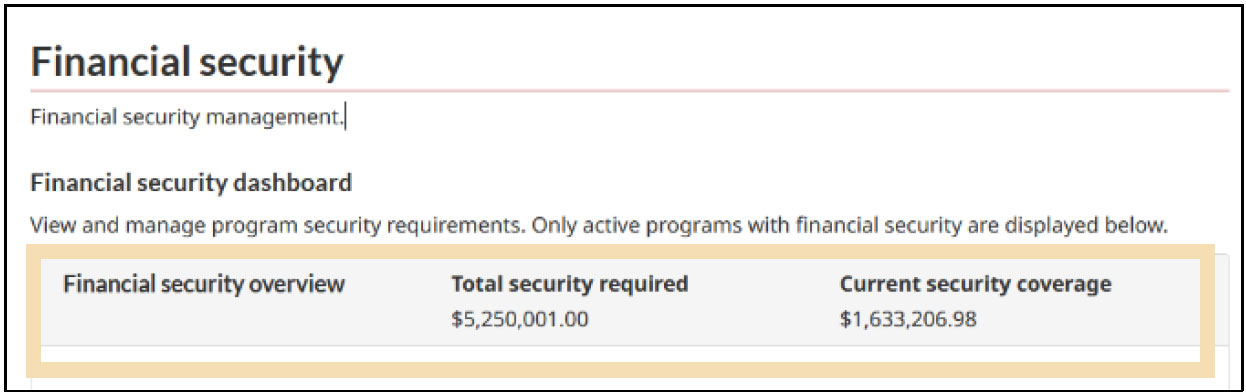

Go to the Financial security page (Home or Menu – Financial information – Financial security) to view your Financial security dashboard.

- The first item listed on the Financial security dashboard displays your Financial security overview, which includes the following:

- Total security required: how much financial security you need for your account

- Current security coverage: how much financial security you have

- Contact your Universal Logistics Client Care Representative to assist with securing your RPP bond.

Importers who have already secured their RPP bond with CBSA:

Here is what you need to do:

Make sure you have the necessary coverage by logging into the CARM Portal to review your current security coverage before the May 20, 2025 deadline. Follow the three steps outlined above.

The CARM system utilizes a nudging framework to encourage real-time compliance with financial security requirements. This framework is specifically designed for RPP importers. If an RPP importer’s financial security utilization exceeds 75% or surpasses 100%, the CARM system will prompt the importer to either increase the financial security posted or make a payment to reduce the account balance.

During the current RPP transition period, ending on May 20, 2025, these nudges or financial security notifications are for information purposes only. They serve as reminders for importers to post the necessary financial security by the end of the transition period in order to continue enjoying the benefits of the RPP privilege.

Universal has secured very competitive RPP Bond rates with our Surety. To take advantage of these rates please contact your Client Care representative or Mark Glionna, Vice President—Client Relations & Business Development.

Rethinking Your Routing Strategy? Ship Direct to Canada

With rising tariffs and ongoing trade tensions, more companies are moving away from U.S.-based sourcing and routing. If you’re importing foreign-origin goods via the U.S., now’s the time to consider bypassing the U.S. and the high U.S. tariffs altogether and shipping directly to Canada. At Universal Logistics, we help businesses optimize supply chains by designing direct international freight solutions that reduce cost, minimize delays, and simplify compliance. Whether you’re sourcing from Asia, UK, Europe, or South America, our global network and hands-on support make direct-to-Canada shipping smooth and strategic.

USA/Canada Trade War: Canada provides relief to manufacturers and key entities

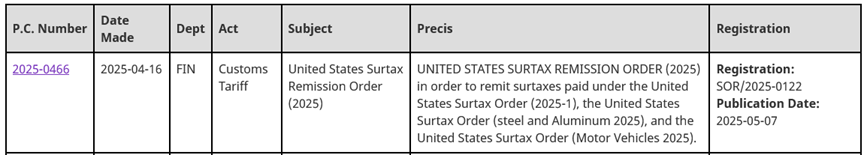

Canada has issued relief of Surtax (USA/Canada Trade War Tariff) for goods imported from the U.S. that are used in Canadian manufacturing, processing, food and beverage packaging, and for those used to support public health, health care, public safety, and national security objectives.

The relief, provided by Order-in-Council 2025-0466, provides immediate relief to a broad cross-section of Canadian businesses that must rely on US inputs to support their competitiveness, as well as to entities integral to Canadians’ health and safety, such as hospitals, long-term care facilities and fire departments. The remission is provided on a time-limited basis to provide businesses and entities with additional time to adjust their supply chains, and prioritize domestic sources of supply, if available, and is retroactive to March 4, 2025.

The Canada Border Services Agency (CBSA) will be administering the claims for remission of tariffs pursuant to the Remission Order. The process for obtaining relief under the Remission Order can be found in the “How to apply” section of the Customs Notice. However, there is no pre-approval required, provided the goods you are importing meet the conditions outlined in the Order.

Regarding the pre-existing remissions framework, a company’s individual remission request will continue to be assessed on a priority basis whether you benefit from this Remission Order or not (i.e. to determine if longer term or more tailored relief is warranted for your company or the goods you import). It is, therefore, important that companies continue to correspond with Department of Finance officials to ensure remission requests are properly substantiated and can be assessed in a timely manner.

Remissions under the United States Remission Order (2025) and assessments as per the remission framework outlined by the Government can be considered separately.

Remission has been provided in the following instances until October 16, 2025:

- Remission — public health, public safety and national security

- Remission — health care

- Remission — manufacture, processing or packaging

- Remission — goods referred to in schedule (refer to limited HS tariff classification list)

Conditions

Remission is granted on the following conditions:

- the good is imported into Canada before October 16, 2025;

- no other claim for relief of the surtax has been granted under the Customs Tariff in respect of the good; and

- the importer makes a claim for remission to the Minister of Public Safety and Emergency Preparedness within two years

after the date of importation.

Clients of Universal Logistics are requested to reach out to your Client Relations Representative to advise if any of the above conditions pertain to your imports so we may take advantage of the relief at time of import.

For more information, contact Brian Rowe, Director – Customs Compliance & Regulatory Affairs.

Canadian Ports Face Prolonged Congestion: What You Need to Know

Ports on the West Coast of Canada have been experiencing congestion, with no relief in sight for another 4-6 weeks at least.

Contributing to the congestion are factors such as poor weather conditions, which delay movement of containers by rail from the port to inland points such as Toronto and Montreal. CPKC and CN enacted winter operating limitations, which involve shorter train lengths and slower speeds, resulting in less containers being loaded to rail.

Another big factor impacting congestion is the realignment of shipping alliances, which is causing delays in vessels and irregular arrival times at ports.

Since arrival times are inconsistent, it has made berth planning more challenging, with late vessels having to wait for a berth, while on-time vessels are being prioritized for offloading.

We are also seeing delays at Canadian East Coast ports. The average import rail dwell time (vessel arrival to departure on rail), for Canadian cargo is as follows:

| 10-13 days |

| 10-13 days |

| 7-10 days |

| 7-10 days |

| 7-10 days |

If your FCL shipments are urgent, please contact Monserrat Vazquez, Manager – Freight Solutions to see if Expedited Rail Service (ERS) is available for your shipment. ERS is a chargeable service option that will speed up the loading of your container to rail and is offered at Prince Rupert, Vancouver and Halifax ports. Requests must be submitted by Universal to the steamship line at least 72 hours prior to docking of the vessel at port, and are offered on a first come/first serve basis.

Global Spotlight Quiz

Name the city that features one of Europe’s largest aquariums

- A vibrant port city with a long maritime history.

- The old port has been transformed into a busy tourist centre.

- Pesto originated in this city.

- The birthplace of blue jeans.

- The great explorer Christopher Columbus was born in this city in 1451.

Answer: Genoa, Italy

For more information about shipping freight to or from this city, contact Debbie McGuire, Director – Freight Solutions.

Quick Tip

By controlling your freight, you can choose the best routing and service level for your business

Time critical? If saving time saves you money, ensure your freight is moving on the fastest route available.

Cost the issue? Deferred services offer good savings.

Different carriers offer various service options, ranging from “no frills” to “executive treatment”.

Choose what works best for you.

At Your Service

Isabelle Lima

Canadian Customs Operations (Head Office)

Isabelle Lima joined Universal Logistics in April 2024, as a member of the Canadian Customs Operations team at our Head Office. In her current role, Isabelle facilitates the customs clearance of courier and rail shipments from the U.S. to Canada.

Isabelle’s outstanding communication skills, combined with her proactive problem-solving, have made her an invaluable asset to the team. She reliably ensures that our clients’ needs are met with excellence, and always takes the initiative to provide top-level service.

Isabelle can be reached by phone (905) 882-4880 ext. 1251 or by email.

Canadian Customs Operations

(Head Office)

SMART Logistics

Controlling how freight moves through your supply chain could save you thousands – or more.

Working with us means someone always asks: how can we make this shipment better?

Single-sourced trucking, customs clearance and distribution to expedite your freight shipments between the U.S. and Canada.

Route is produced monthly for the clients of Universal Logistics. Reader comment and story ideas are welcome. Comments of general interest to all Route readers will, with the permission of the writer, be published. Copyright © 2025 Universal Logistics Inc. All rights reserved. Reproduction for any commercial use is strictly prohibited.

Route is produced by Universal Logistics. Editor: Bettina Scharnberg. Email: bscharnberg@universallogistics.ca While every effort has been made to ensure the accuracy of information contained herein, Universal Logistics accepts no responsibility or liability for errors or omissions. Written correspondence should be forwarded to: