Universal’s Community Giving

Our corporate wide adherence to family values includes a great commitment to giving back to the community that peaks during the holiday season. “We always try to best the previous year’s results and this year was no different as our employees at every level and every location participated enthusiastically,” said Company President, Michael Glionna.

Most significant this year is the fantastic amount of funds raised for Hockey Helps the Homeless (HHTH), a Canadian charity that organizes and runs fantasy hockey tournaments across the country and raises money to help fund the work of over 40 homeless support agencies. The funds raised by Universal benefit 360Kids (www.360kids.ca) and Blue Door Shelters (www.bluedoor.ca), two local organizations committed to ending homelessness.

In October and November, six employee teams at Universal rallied together to raise an incredible $32,038! Together with the company’s funds matching program and serving as participant gift sponsor for HHTH’s York Region tournament, a total contribution exceeding $70,000 was made by the Universal group.

Even more giving took place in December as our employees generously donated to two other charities we support annually: the Vaughan Food Bank and the Toy Mountain gift drive. “It is a great feeling knowing that the multitude of food and gifts contributed by our employees will bring joy this holiday season to those who are less fortunate,” said Mark Glionna, Vice President – Client Relations & Business Development.

CARM – Now is the time to get your bond

When CARM became the official system of record, obtaining the release of imported goods prior to accounting and payment of duties significantly changed for importers. Importers are no longer able to use their customs broker’s security to clear shipments before paying duties and taxes.

CARM requires all importers to post security with CBSA to guarantee the payment of duties and taxes before goods will be customs released (Release Prior to Payment – RPP).

The Release Prior to Payment (RPP) Program allows participants to obtain the release of goods from the CBSA before the final accounting and payment of duties and taxes.

- With over 250,000 importers requiring bonds, surety companies will be faced with an influx of bond requests within a relatively short period of time – to avoid being caught without a bond after the transition period, we recommend obtaining the required bond now.

Importers who have not yet obtained a bond – here’s what you need to know:

The Release Prior to Payment (RPP) 180-day transition period, which extends from October 21, 2024, to April 19, 2025, allows importers up to 180 calendar days to make their own financial security arrangements to meet the RPP program requirements.

All importers must post security using one of the following two options to be eligible for RPP:

- Option 1: a financial security instrument for 50% of their highest monthly accounts receivable (inclusive of GST) with a minimum financial security of $5,000 per import program (RM)

- Option 2: cash security deposit for 100% of their highest monthly accounts receivable (inclusive of GST)

Recommendation – obtain a bond for a higher amount than required to avoid costly revisions

IMPORTANT: If financial security is not provided within the 180-day transition period, the importer will be removed from the RPP program (at day 181). Without the required bond, you will be required to pay CBSA in advance for all duties/taxes prior to gaining the release of imported shipments after the 180-day transition period.

Importers who already have a bond – ensure you have enough coverage:

How will financial Security be monitored, and when will the nudging begin?

The CARM system uses a nudging framework to encourage real-time compliance with financial security requirements. The nudging framework is used for RPP importers only. When an RPP importer’s financial security utilization is approaching (for example, greater than 75%) or over capacity (greater than 100%), the CARM system will nudge the importer to either increase the financial security posted or post-payment to reduce the account balance.

During the current 180-day RPP transition period, these ‘nudges’ or financial security notifications are for information purposes only, reminding importers to post the applicable financial security before the end of the 180-day transition period to continue benefiting from the RPP privilege.

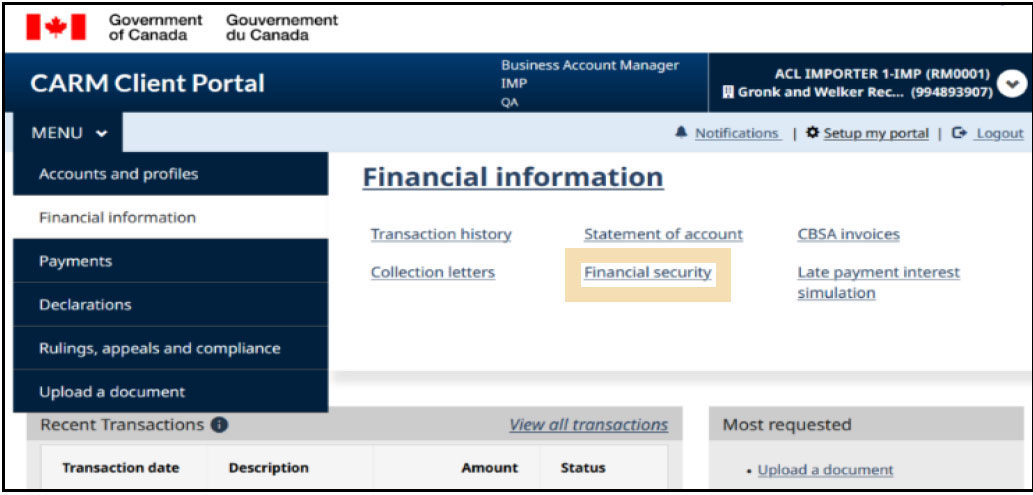

To determine your security requirements, log into the CARM Portal and select “Financial Security” (note, only you can see these screens in CARM; your service providers cannot):

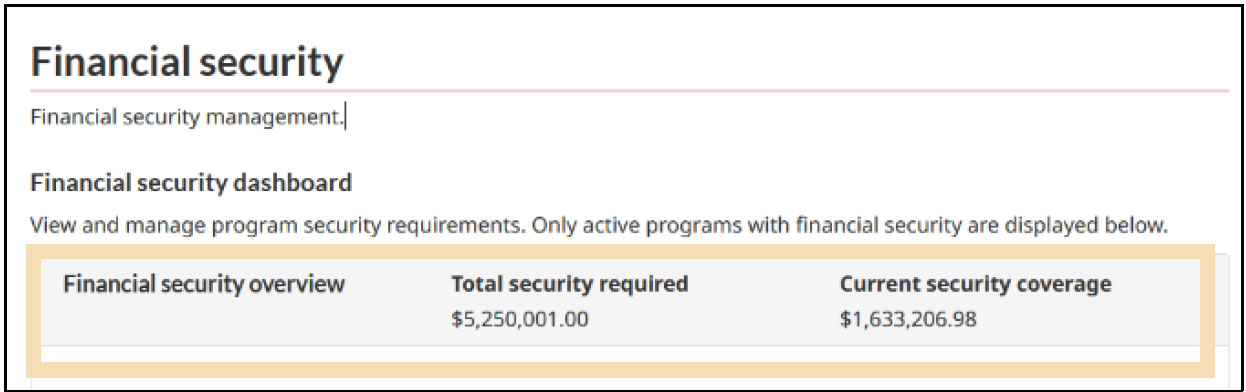

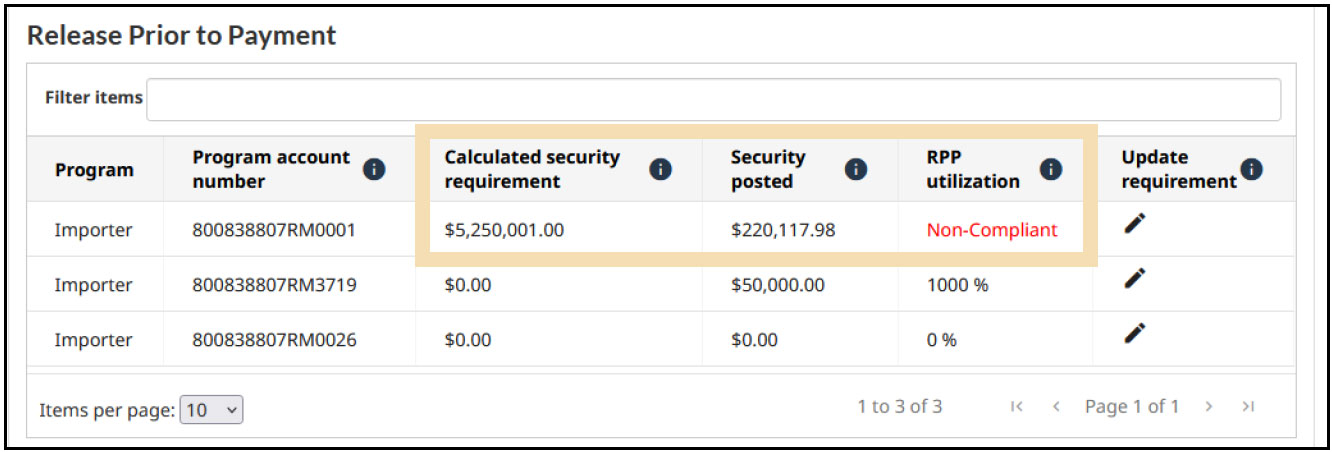

You will then see the following screen advising your current security details. If your Total Security Required exceeds your Current Security Coverage, then an increase to your RPP Bond is required:

In the CARM Client Portal, the importer will land automatically on their Financial Security Dashboard. They will then know the amount of financial security they have to post by looking at the Security Requirement field.

Universal has secured very competitive RPP Bond rates with our Surety. To take advantage of these rates please feel free to contact your Client Care representative or Mark Glionna, Vice President—Client Relations & Business Development.

Simplify CUSMA/USMCA Compliance with Universal Logistics

Universal Logistics makes CUSMA/USMCA certificate renewals and compliance management simple. Our experienced specialists ensure timely, accurate updates and proactively address risks before they impact your bottom line. From classification and documentation review to long-term recordkeeping, we handle it all—so you can focus on your core business. Ready to streamline your compliance process? Contact us today and let our experts guide you.

Importance of Supply Chain Vulnerability Awareness

To say the past year has been interesting and unique in regard to the overall North American supply chain is an understatement. Unprecedented labour unrest had a massive effect on both ocean shipping as well as rail service. The question that remains is how well informed are key players such as government, both federal/provincial and federal/state, as well as the media who deliver the updates on such occurrences. While shippers, importers, customs brokers, freight forwarders and business organizations who are directly and immediately impacted by such unrest, are painfully aware of the repercussions, based on what transpired in 2024 there seems to be a need for more education/awareness for those who can effect change (government) and those whose role it is to report on such instances (media).

What we are seeing over and over again is that there truly seems to be a lack of insight into how important supply chains are to fueling our economies and how even a short disruption can lead to massive repercussions. The following will highlight some of the key impacts of these “short term” labour disputes and why it is so important to realize the severe and immediate impact on overall economies in general.

Port and Rail Overview

US Ports

- The 2024 US East Coast port strike that lasted three days (October 1 to October 3) was the largest shutdown of its kind in almost 50 years.

- Given that more than 40% of total containerized goods enter the U.S. via ports on the East and Gulf Coast, the stakes could not be higher.

- The impact of the strike was significant, costing the US economy up to $5 billion per day and causing delays in essential goods.

Canadian Ports

- The Montreal and British Columbia port strikes resulted in 70% of Canadian container traffic on full stop, according to the Canadian Chamber of Commerce.

- The combined work stoppages in British Columbia and Montreal impacted the flow of $1.2 billion dollars worth of goods daily.

Rail

- The CN And CPKC Rail Strike – from lockout to ordering trains to resume operations – lasted only a day, however, the impact extended widely across the supply chain (imports and exports), had US trade implications and affected commuter train functionality for tens of thousands of people, creating a myriad of ripple effects.

- More than 900,000 metric tons of goods move daily on Canada’s railways, according to the Railway Association of Canada, with the work stoppage impacting the movement of $1 billion in goods daily.

Overall Effects Not Typically Highlighted

- Regional Impact: There is a misconception that such labour action has limited regional effect, which cannot be further from the truth. Ports act as hubs to facilitate the disbursement of goods across North America, as do railway networks and, if compromised, will have broad implications.

- Delays: While there is a focus on inbound product, typically related to key retail yearly events such as Christmas, supply delays have far reaching implications. Producers will not get the needed parts and materials on time and, as such, customers have to wait for finished goods.

- Shortages: Inventory supply or lack thereof is always mentioned, but just-in-time production materials are also crucial. Lack of parts, materials or components could lead to productions stops and enterprises or entire industries could be forced to shut down.

- Loss in revenue and job cuts: If manufacturers cannot deliver goods, less revenue is generated. Loss of profitability can, thus, lead to layoffs

- Contract fines and damage to reputation: Enterprises could face penalties for late delivery or non-fulfilment of contract. Business partners or consumers may lose trust.

A key point highlighted above that never seems to get mentioned in media reports related to these labour issues, is the role supply chains, especially international supply chains, play in providing critical parts needed to keep Canadian and US factories (and plant jobs) running. There tends to be a lot of discussion on supply shortages and the effect on consumers, namely related to retail inventory/supply and, while this is very true, there is definitely a lack of awareness of how crucial these shipments are to fueling manufacturing and how quickly such manufacturing can be compromised as a result of such delays. Factory shutdowns are very common during such labour unrests, which is rarely mentioned prior to predicted strikes or lockouts, despite the vast economic impact they can have at a local as well as a nation wide level.

Another important point is that it is not just the big players who will feel the heat. Small and medium-sized businesses are likely to be hit hardest due to lack of flexibility in contracts comparing to larger companies, making them more vulnerable to increased costs and delays when shipment plans change. For example, for distributors serving multiple large retailers, even a small delay can mean they can’t meet their contractual obligations, which could lead to large penalties.

As we head into 2025, the hope is that overall increased supply chain vulnerability awareness has increased and when we encounter such disruptions, which is inevitable, we will all be better informed and understand the overall ramifications. While solutions to such occurrences can be a challenge, having a clear understanding of the overall effect is key and as history has shown, we would be naive to assume such matters are behind us.

For more information, contact David Lychek, Director – Ocean & Air Services.

Plan early to ship goods before Chinese New Year

The weeks leading up to Chinese New Year (CNY) put incredible pressure on exporters in China and China’s transportation infrastructure. CNY is generally a 7 day festival, however, most people in China celebrate for up to two weeks or more.

Factories shut down over the holiday and, after they reopen, it can take a few weeks to get back to full production capacity.

Proper planning and coordination are important if you want to ensure your supply chain remains fluid.

Chinese New Year 2025 falls on the following dates:

- China: January 28, 2025 – February 4, 2025

- Hong Kong: January 29, 2025 – February 2, 2025

- Taiwan: January 28, 2025 – February 2, 2025

If you have shipments that need to depart prior to Chinese New Year, we recommend that you place bookings with our Freight Solutions Team in mid to late December, ensuring enough lead time to find the best option for space and rates.

For more information, contact Debbie McGuire, Director – Freight Solutions.

GST/HST Holiday Tax Break

The Canadian Federal Government has implemented a temporary GST/HST holiday break on certain goods effective December 14, 2024 and ending February 15, 2025.

The items that qualify for GST/HST relief during this period qualify throughout the supply chain, whether they are being supplied from a manufacturer to a wholesaler, or from a wholesaler or a retailer to a consumer.

Imported goods qualify for the temporary GST/HST relief as long as they meet the other qualifying conditions.

Which types of items qualify for the GST/HST break:

Type of qualifying product or service | Details, examples, and restrictions |

Food | Details, examples, and restrictions of food Updated: December 11, 2024 |

Beverages | Details, examples, and restrictions of Beverages Updated: December 11, 2024 |

Restaurants, catering, and other food or drink establishments | Details, examples, and restrictions of Restaurants, catering, and other food or drink establishments Updated: December 6, 2024 |

Children’s clothing and footwear | Details, examples, and restrictions of children’s clothing and footwear |

Children’s diapers | |

Children’s car seats | |

Children’s toys | |

Jigsaw puzzles | Jigsaw puzzles for all ages qualify |

Video game consoles, controllers, and physical video games | Details, examples, and restrictions of children’s video game consoles, controllers, and games |

Physical books | |

Printed newspapers | |

Christmas and similar decorative trees | Details, examples, and restrictions of Christmas trees and similar decorative trees Updated: December 11, 2024 |

Additional details on qualifying goods:

The following are descriptions of goods that would qualify for the proposed tax relief.

- Children’s clothing: meaning garments (other than garments of a class that are used exclusively in sports or recreational activities, costumes, children’s diapers, or children’s footwear) that are:

- Designed for babies, including baby bibs, bunting blankets and receiving blankets;

- Children’s garments up to girls size 16 or boys size 20, according to the national standard applicable to the garments, and if no national standard applies to the children’s garments, girls or boys sizes extra small, small, medium, or large; or,

- Hosiery or stretchy socks, hats, ties, scarves, belts, suspenders, or mittens and gloves in sizes and styles designed for children or babies.

- Children’s footwear: meaning footwear (other than stockings, socks or similar footwear or footwear of a class that is used exclusively in sports or recreational activities) that is designed for babies or children and has an insole length of 24.25 centimetres or less.

- Children’s diapers: meaning a product designed for babies or children and that is a diaper, a diaper insert or liner, a training pant, or a rubber pant designed for use in conjunction with any of those items.

- Children’s car seats: meaning a restraint system or booster seat that conforms to the Canada Motor Vehicle Safety Standard 213, 213.1, 213.2 or 213.5 under the Motor Vehicle Restraint Systems and Booster Seats Safety Regulations.

- Print newspapers: meaning print newspapers containing news, editorials, feature stories, or other information of interest to the general public that are published at regular intervals. They would not include electronic or digital publications. They would also exclude most fliers, inserts, magazines, periodicals, or shoppers.

- Printed books: including a printed book or an update of such a book, an audio recording where 90 per cent or more of it is a spoken reading of a printed book, or a bound or unbound printed version of scripture of any religion. However, they would not include:

- a magazine or periodical purchased individually, not through a subscription;

- a magazine or periodical in which the printed space devoted to advertising is more than 5 per cent of the total printed space;

- a brochure or pamphlet;

- a sales catalogue, a price list or advertising material;

- a warranty booklet or an owner’s manual;

- a book designed primarily for writing on;

- a colouring book or a book designed primarily for drawing on or for affixing or inserting items such as clippings, pictures, coins, stamps, or stickers;

- a cut-out book or a press-out book;

- a program relating to an event or performance;

- an agenda, calendar, syllabus or timetable;

- a directory, an assemblage of charts or an assemblage of street or road maps (other than a guidebook or an atlas that consists in whole or in part of maps other than street or road maps);

- a rate book; or,

- an assemblage of blueprints, patterns, or stencils.

- Christmas trees or similar decorative trees: whether natural or artificial.

- Food or beverages: items for human consumption that are:

- Alcoholic beverages (excluding spirits but including wine, beer, ciders, and spirit coolers up to 7 per cent ABV);

- Carbonated beverages, non-carbonated fruit juice or fruit flavoured beverages or products that, when added to water, produce one of these beverages;

- Candies; confectionery classed as candy or goods sold as candies (e.g., candy floss, chewing gum, and chocolate); fruits, seeds, nuts or popcorn coated or treated with candy, chocolate, honey, molasses, sugar, syrup, or artificial sweeteners;

- Chips, crisps, puffs, curls, or sticks (e.g., potato chips, corn chips, cheese puffs, potato sticks, bacon crisps, and cheese curls), popcorn, brittle pretzels, and salted nuts or seeds;

- Granola products and snack mixtures that contain cereals, nuts, seeds, dried fruit, or other edible products;

- Ice lollies, juice bars, ice waters, ice cream, ice milk, sherbet, frozen yoghurt or frozen pudding, including non-dairy substitutes;

- Fruit bars, rolls or drops or similar fruit-based snack foods;

- Cakes, muffins, pies, pastries, tarts, cookies, doughnuts, brownies, croissants with sweetened filling or coating (note that many bread products, such as bagels, English muffins, croissants, and bread rolls, are already zero-rated);

- Pudding, including flavoured gelatine, mousse, flavoured whipped dessert product, or any other products similar to pudding;

- Prepared salads, sandwiches, platters of cheese, cold cuts, fruit or vegetables, and other arrangements of prepared food;

- Food or beverages heated for consumption;

- Beverages dispensed at the place where they are sold;

- Food or beverages sold in conjunction with catering services;

- Food or beverages sold at an establishment where all or substantially all of the food or beverages sold are currently excluded from zero-rating (e.g., a restaurant, coffee shop, take-out outlet, pub, mobile canteen, lunch counter, or concession stand); and

- Bottled water or unbottled water that is dispensed at a permanent establishment of the supplier.

- Select children’s toys: a product that is designed for use by children under 14 years of age in learning or play and that is:

- a board game or card game (e.g., a strategy board game, playing cards, or a matching/memory card game);

- a toy that imitates another item (e.g., a doll house, a toy car or truck, a toy farm set, or an action figure);

- a doll, plush toy or soft toy (e.g., a teddy bear); or,

- a construction toy (e.g., building blocks, such as Lego, STEM assembly kits, or plasticine).

- Jigsaw puzzles, for all ages.

- Video-game consoles, controllers or physical game media (e.g., a video-game cartridge or disc).

For more information, contact Brian Rowe, Director – Customs Compliance & Regulatory Affairs.

PFAS Substances – Mandatory response due January 2025

The Government of Canada is reminding importers/manufacturers of their requirement to respond to an information gathering initiative that applies to certain per- and polyfluoroalkyl substances (PFAS).

The purpose of the notice is to collect information on certain PFAS substances, either alone, in mixtures, products, or manufactured items in Canadian commerce for the calendar year 2023. The deadline for responding to the notice is January 29, 2025.

Who is required to respond (notice sections 2 to 6)

The notice applies to any person who, during the 2023 calendar year, satisfied any of the following criteria:

- manufactured a total quantity greater than 1000 g of a substance listed in Schedule 1

- imported a total quantity greater than 10 g of a substance listed in Part 1 of Schedule 1, OR a total quantity greater than 100 kg of a substance listed in Part 2 or Part 3 of Schedule 1, whether the substance was alone, or at a concentration equal to or above 1 ppm in a mixture or in a product or at a concentration equal to or above 1 ppm in one of the categories of manufactured items

- imported a total quantity greater than 100 kg of any substance listed in Schedule 1 at a concentration equal to or above 1 ppm in a manufactured item NOT listed in the categories of manufactured items

- used a total quantity greater than 10 g of a substance listed in Schedule 1, whether the substance was alone, or at a concentration equal to or above 1 ppm in a mixture or in a product, in the manufacture of a mixture, a product or a manufactured item

As example, following are some imported manufactured item examples – refer to the regulation guide for full list of examples and product categories:

Intended to be used by or for children under the age of 14 years:

- play mats

- pacifiers

- toys for babies, toddlers and children

- board books

- teething toys

- plastic toy jewellery

Intended to come into contact with the mucosa of an individual:

- cotton-tipped applicators

- mouth guards

- dentures

- orthodontic equipment (for example, braces, retainers)

- hearing aids

- nasal spray applicator

- thermometers

- tampons

- condoms

- contact lenses

Used as intended such that the substance may be inhaled, or come into dermal or oral contact with an individual:

- Scented paper items

- air fresheners

- candles

- markers

- dryer sheets

- cleaning wipes

- face masks / shields

- beauty face masks

- disposable / non-disposable gloves

- mouth guard

- mobile phone cases

CEPA section 71 response

If you meet the reporting criteria of the notice, you must respond to the notice by submitting the required information in an Excel Reporting File (ERF) to the Government of Canada.

- Download the PFAS ERF from the Responding to the PFAS notice webpage

- Complete the required information (detailed instructions on how to complete the ERF are included in Annex A)

- Submit the ERF to the Government via Environment and Climate Change Canada’s Single Window (instructions on how to submit the ERF through Single Window are included in Annex B)

Obtaining information from foreign suppliers to meet the information requirements for substances in imported manufactured items is strongly encouraged; if the information does not appear to be accessible within the reporting period, please contact us at substances@ec.gc.ca to request an extension (see section 5 below).

Reporting deadline & extensions

Any person who is required to respond to the notice must do so no later than January 29, 2025 using ECCC’s online reporting system. Requests for additional time to respond to the notice must be submitted in writing to substances@ec.gc.ca and must include:

- the organization name

- contact information

- substance identifier(s) involved

- the reason for the request

You must request an extension of time in writing before the reporting deadline. It is recommended that you request an extension of time at least 5 business days prior to the deadline and include a new proposed date for your submission. Indicate in the subject line of your email “PFAS Notice Extension Request”. A request for an extension of time submitted after the deadline of January 29, 2025, will not be granted. When making your request, please specify the duration for which you need the extension.

For more information please email substances@ec.gc.ca.

For more information, contact Brian Rowe, Director – Customs Compliance & Regulatory Affairs.

Global Spotlight Quiz

Name the city featuring a Ferris wheel built over a bridge

- Has one of the busiest ports in the world.

- The city’s ‘Five Great Avenues’ district is a popular tourist attraction.

- The city’s name means ‘Heavenly Ford’.

- The city center is a mixture of neoclassical art deco palaces mixed with very tall contemporary skyscrapers.

- Features ‘Fantawild Adventure’ amusement park – the city’s answer to Disney World.

For more information about shipping freight to or from this city, contact Debbie McGuire, Director – Freight Solutions.

Quick Tip

Cargo Liability versus Cargo Insurance

Don’t make the mistake of assuming that Cargo Liability and Cargo Insurance are the same thing. They are not. Cargo Liability is the maximum amount of liability a carrier will assume if they are determined to be 100 percent at fault which must be stated on their Bill of Lading. Cargo Insurance is purchased by the shipper for protection against losses resulting from all perils (loss, damage, theft) and can cover more than 100% of the cargo’s value.

At Your Service

Chloe Doan

Canadian Customs Operations

Chloe Doan joined Universal Logistics in January 2023, as a member of the Canadian Customs Operations team at our head office. In her current role, Chloe facilitates the customs clearance of truck and rail shipments from the U.S. to Canada.

Chloe’s strong customer service skills, along with meticulous attention to detail, have made her an indispensable member of the team, consistently ensuring that our clients’ needs are met.

Chloe can be reached by phone (905) 882-4880, ext. 1239 or by email.

Canadian Customs Operations

SMART Logistics

Controlling how freight moves through your supply chain could save you thousands – or more.

Working with us means someone always asks: how can we make this shipment better?

Single-sourced trucking, customs clearance and distribution to expedite your freight shipments between the U.S. and Canada.

Route is produced monthly for the clients of Universal Logistics. Reader comment and story ideas are welcome. Comments of general interest to all Route readers will, with the permission of the writer, be published. Copyright © 2024 Universal Logistics Inc. All rights reserved. Reproduction for any commercial use is strictly prohibited.

Route is produced by Universal Logistics. Editor: Bettina Scharnberg. Email: bscharnberg@universallogistics.ca While every effort has been made to ensure the accuracy of information contained herein, Universal Logistics accepts no responsibility or liability for errors or omissions. Written correspondence should be forwarded to: